Medium-term Management Plan

Medium-term Management Plan

Our company was started in 2019 as a pure holding company, Restar Holdings, through the business merger of two semiconductor trading companies, UKC Holdings and Vitec Holdings, which inherited the exclusive distributor of SONY. Since then, we have expanded our business through a series of new M&As and capital and business alliances in the device field, and in April 2024, Restar Holdings and three group companies merged to form a new company, Restar Corporation.

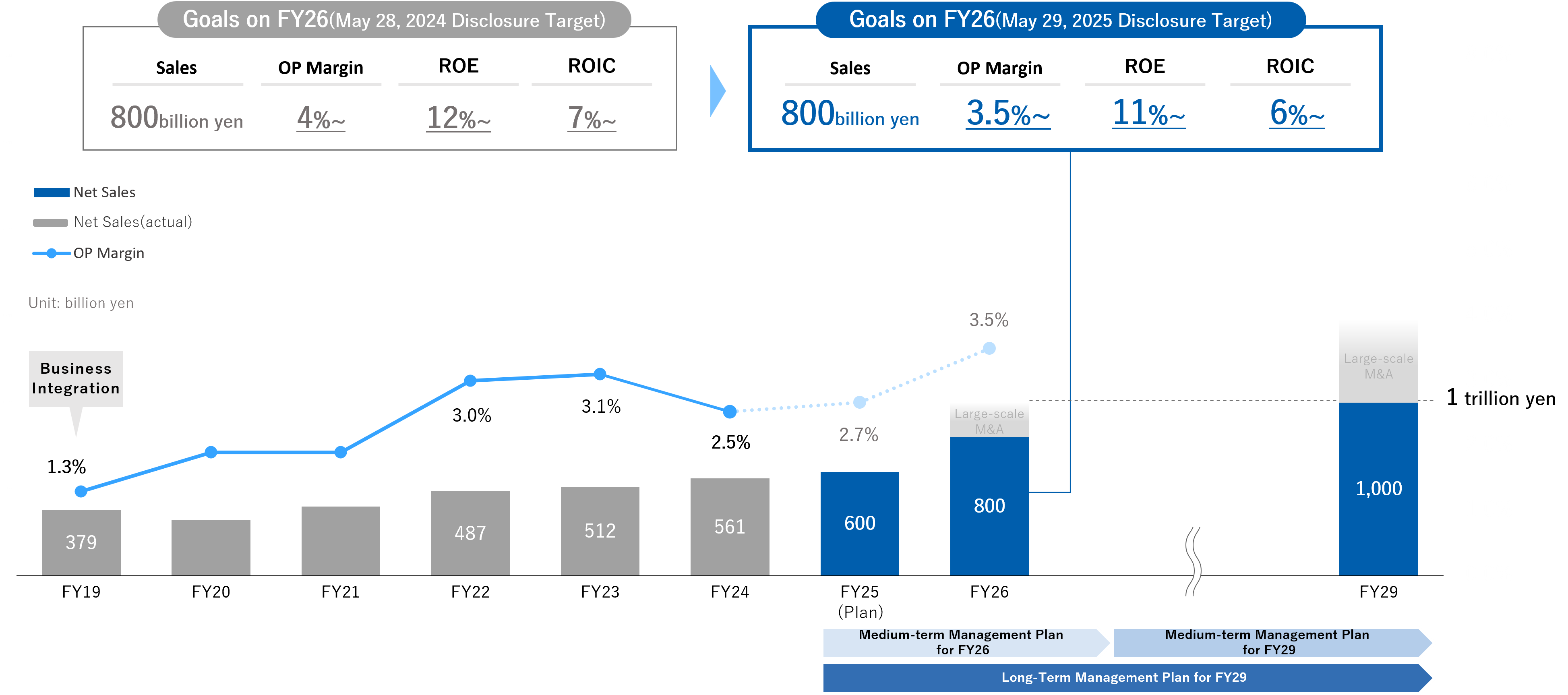

To further increase corporate value and ensure that the Group continues to make rapid progress, we have formulated a Medium-term management plan through the fiscal year ending March 31, 2027.

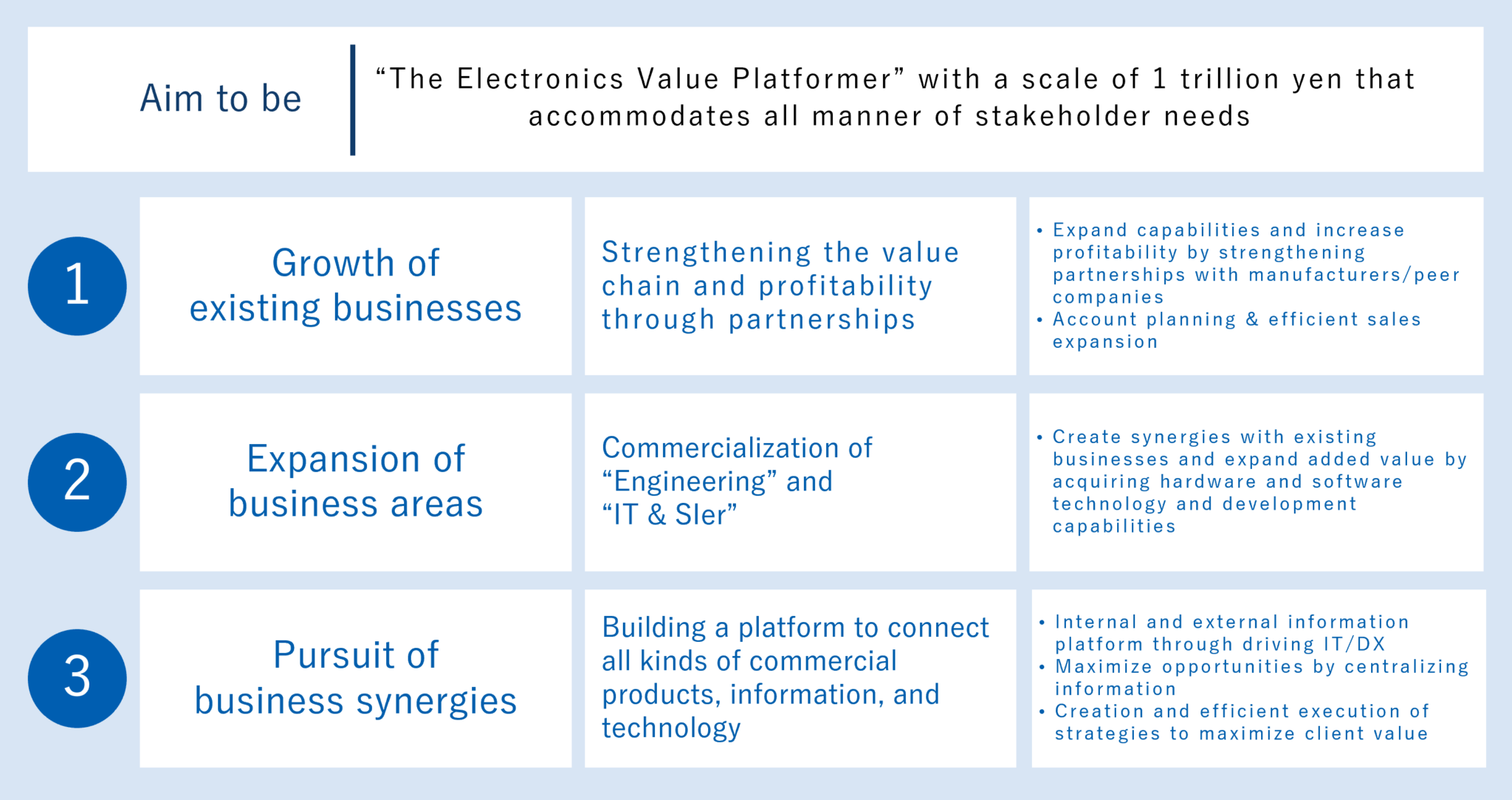

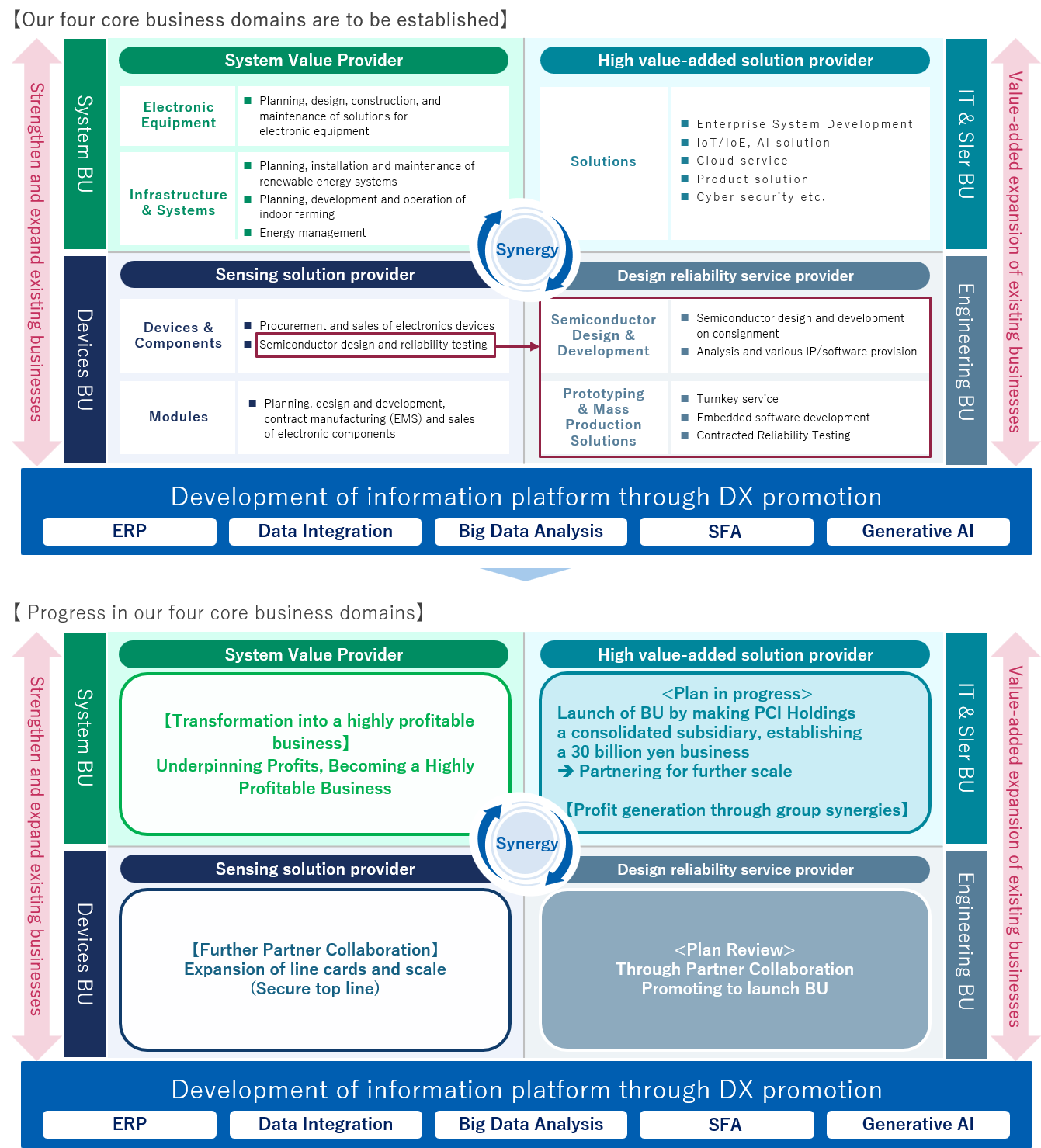

While our original business as a semiconductor trading company will remain at the core of our operations, we will aim to grow our existing businesses such as video and audio systems, energy, and vegetable factories, without being biased toward the device business. We will work with various partners to strengthen our value while improving profitability.

Furthermore, we will strive to expand business areas of engineering and IT&SIer businesses in order to transform our current profit structure by incorporating hardware and software technologies and expanding added value with existing businesses.

In addition, to pursue business synergies, we will build a platform to unify various information obtained through existing and new businesses. We will transform individual information into value in the form of solutions and evolve into “The Electronics Value Platformer” that accommodates all manner of stakeholder needs.

In our Medium-term management plan through the fiscal year ending March 31, 2027, we aim to achieve our goals by adding new businesses in addition to organic growth of existing businesses while maintaining financial discipline.

To transform information into tangible value, evolving into a platformer that resolves all challenges for our customers and suppliers.

In consideration of the balance between stable and enhanced shareholder returns, proactive investment in growth areas, and financial soundness, we will maintain a consolidated dividend on equity ratio (DOE) of 4% or more. We will increase dividends stably and continuously, and consider flexible share buybacks for surplus funds.

Since the dividend on equity ratio is based on shareholders’ equity, it is less sensitive to fluctuations in profits than the dividend payout ratio, and is an indicator for stable dividend policy. We consider DOE as an important indicator for shareholder return so that our shareholders can hold our shares for a long period of time with a sense of security.

*DOE (Dividend on Equity): Ratio of dividends to shareholders’ equity = Dividend amount / Shareholders’ equity = Dividend yield x PBR

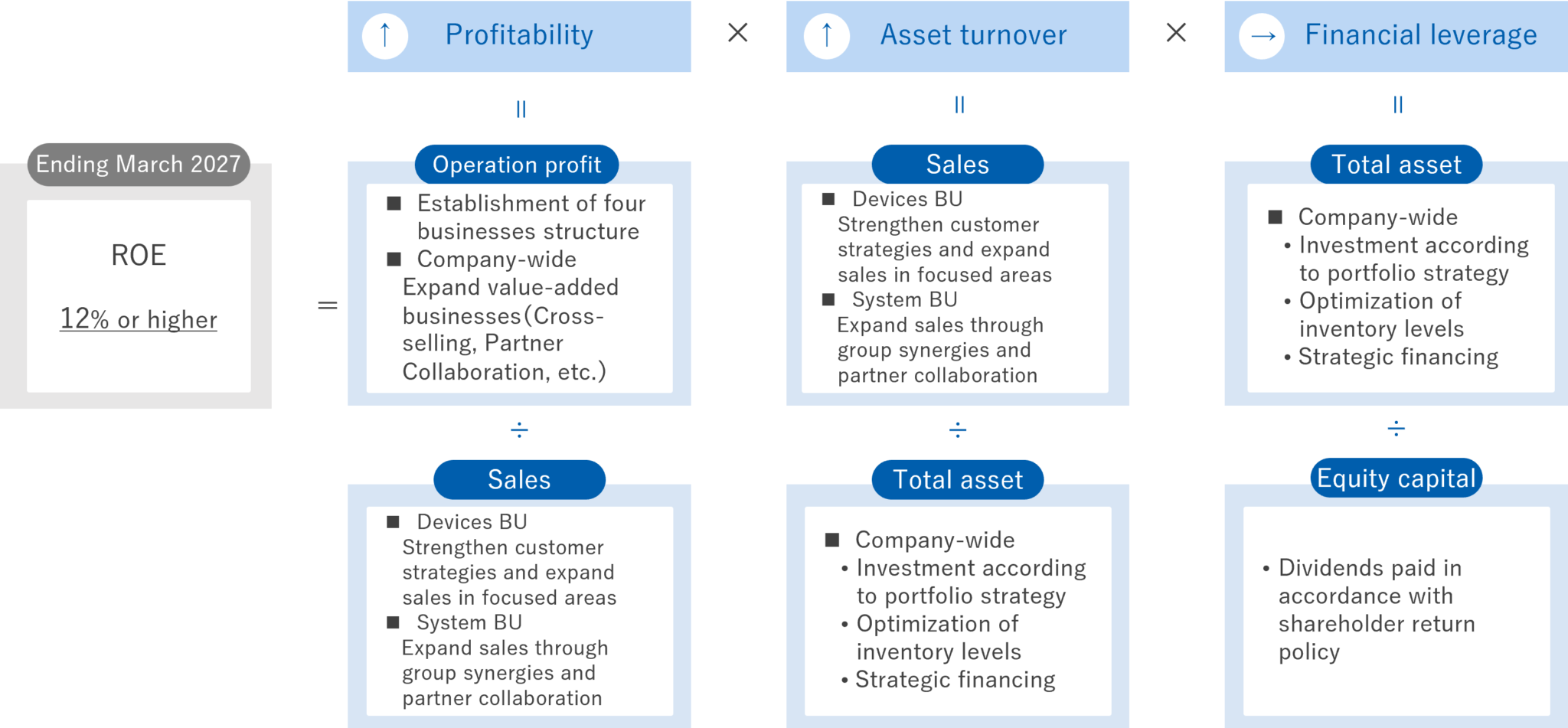

We will implement the following measures in terms of profitability, capital turnover, and financial leverage, with the goal of achieving ROE of 12% or more for the fiscal year ending March 31, 2027.